Common Cents # 9 Investments

Last week we discussed that part of everything we make is

ours to keep. The idea is that ten percent of what we make should first be given

away to Non-Profit works we support or for the Believer, returned to God. The second

ten percent is ours to keep. That means invested and not spent.

Even if we agree with this concept, it is not always

possible to implement it with our next paycheck if it has not been our strategy

before. The first thing we must do is to

look at our current percentages and see, over a period of time, when these

goals can be achieved.

When we write a check, pull out some cash or a credit card,

we are doing one of two things: spending or investing. If the item we are

paying for is consumed, such as food, gasoline, or electricity, it is spending.

If we can get our money back later, hopefully after it has grown a little, we

call it investing.

There are a few areas where the line is blurry. For example,

if we are making a mortgage payment on a house, the part that is interest,

taxes, and insurance is spending. But the part that goes to increase our

ownership in the house, paying down the balance, might correctly be considered

investing. If at a later date we sell the house, we will most likely get that money

back, probably increased by inflation. So in that case our home may well be a

good investment. One does not really know until it is sold. However, we do know that rent paid is just

spending.

So, what about other investments? Anything that we can easily

sell for at least as much as we paid is considered a good investment. We

sometimes talk about investments in terms of liquidity. Liquidity is a clever

word that means how easily an item can be sold or converted to cash. A stack of

one hundred dollar bills is very liquid, they can be spent right now. A house

is not very liquid because it could take months to sell.

A good place to park our money where it is reasonably

secure, at least in the long-run, and is quite liquid is the stock market. If we

get really excited about investigating companies and making decisions about

their long-term viability and feel we want to be part of that company, buying

individual stock may be what we do. For most of us, we would rather make small

investments in a large number of companies over a large number of industries

and let professionals pick the individual stocks. We call this shopping cart of

stocks a mutual fund. Anyone can go to one of the many web sites operated by

mutual fund companies, choose a fund, write a check or transfer the money and

become a proud owner of a chuck of the American (or world) economy. One can

also go through a stockbroker or financial planner. Many people who work for a

company with employee benefits can have money deducted from their paycheck and

invested in mutual funds through a program such as a 401(k) retirement plan.

Setting up an account with an online brokerage company and

putting in a small amount every month is one the smartest things we can do. As

we have seen in the past few months, the stock market can be volatile over the

short term with big swings in prices in just a few days. However, the long-term

trend over five years, ten years, or more has proven to outpace inflation and

increase in value. Understanding our

tolerance for risk is required and investments made accordingly, but the stock

market is an essential part of long-term financial success.

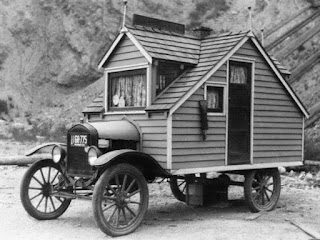

Next week I will talk about some other forms of investing

such as collectibles, musical instruments, and vintage cars.