Monday, June 15, 2020

Common Cents # 8 The Richest Man in Babylon

Monday, June 8, 2020

Common Cents # 7

Common Cents #7 - Where Are We?

George Gruhn owns Gruhn’s Guitar in Nashville and is considered to be the world’s foremost authority on guitars. He started his business when he was in Graduate School at the University of Tennessee in 1971. He currently hosts a weekly Zoom-cast on Friday afternoons and I’ve really been enjoying hearing his interesting ideas, honest opinions, and personal stories from his many years of being in business.

Mr. Gruhn answers questions that people send in on a wide range

of subjects. Recently a writer asked if he had any regrets after 50 years in

business or if there was anything he would have done differently. He

immediately said that he wished he had taken business courses in college, or at

least hired a business manager early on. He said if he, or someone on staff

that he trusted, had been better versed in things like insurance, taxes, and accounts

payable, he would have been much better prepared to face the highs and lows of

the business and the economy in general. If we own a business, the details and

skills of operating the business are just as important as the actual service it

provides or product it creates.

I have been a business owner for 55 years. For 45 of those

years the business has been photography. I have never claimed to be the world’s

greatest photographer. In fact, I spend much of my time studying other people’s

photographs and searching for ways to improve mine. I have been able to make a

living in photography because I was a businessman first. The product I sell is

photographs.

During the years that I was a tax professional, many of my

clients were small businesses. It was amazing when a client would come in with

incomplete records, disorganized records, or in some cases, no paperwork at

all. They had no idea how they were doing and had no clear way to make wise business

decisions without adequate data. A lack of contemporary records or inadequate

records is also the fastest way to get audited. If a business cannot provide organized

records and receipts with adequate documentation to the IRS to support the tax

return, it will lose the audit process every time.

Even if we do not own a regular business, our households should

be considered to be small businesses. My wife and I consider ourselves “Jim and

Louise, Inc.” Though we are not actually incorporated, we could be; we keep

detailed records as if we were. We have current balance sheets, monthly

income-expense statements, and keep an ongoing account of projected cash-flow.

We do this for both our personal finances and for my photography business. It takes less time than one might think once

the files are set up with the information that one needs to be recorded.

If we look at a map to see how to get to where we want to

go, the most important thing is to determine where we are now. The big

advantage and the beauty of GPS is that it shows where we are now. The

direction we want to go in our financial life is the same. A Balance Sheet, sometimes called a Net Worth

Statement, is where we are now. It is a snapshot. It is a list of what we own,

our assets, and everything we owe, our liabilities. Subtracting the liabilities

from the assets gives our net worth. Its usefulness comes from having a series

of balance sheets over time to see if our net worth is increasing or

decreasing. We can increase our net worth by either increasing our assets or

lowering our liabilities.

Deciding where we want to go in our financial life becomes

possible when we see where we are now, and whether we update the numbers

ourselves or pay someone like George Gruhn wished he had, it is valuable

information for our progress toward our desired goals.

Monday, June 1, 2020

Common Cents #6

Common Cents # 6 for June 1, 2020

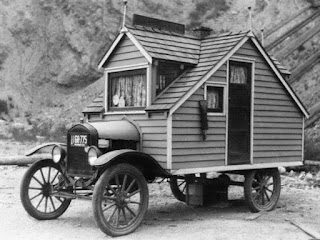

Let’s talk about cars. Some places where public transportation is quick and reliable, cars are a luxury. For most of us they are a necessity. For most people, an automobile is the second most valuable piece of property owned after the cost of their house or apartment lease.

Cars can tell other people about one’s lifestyle and

personal taste, or it can simply be a way to bring home groceries. It can represent a ticket to freedom or it

can be a heavy weight of responsibility and expense. Because it is a costly and

depreciating asset, it is important to know how we view our automobiles and

seek ways to be wise with purchasing, maintaining, and then selling our

car.

So how do I go about buying a car? There are four tiers and

a wild card. The top tier is a new car from a dealer. Driving a new car off the lot with a new car warranty is about the

safest way to have dependable transportation for the length of the warranty,

providing that the car is correctly maintained even as a new vehicle. The argument against buying a brand-new car

is high first year depreciation. Since most new cars are sold at a discount and

feature special financing, rebates, or longer warranties, first year

depreciation is not as big a deal as most people think, especially if the car

is owned for many years.

The second tier is Certified Pre-owned or CPO. This low

mileage one or two-year-old car would be purchased from a reputable new car

dealer that has essentially a new car warranty. This often proves to be an

excellent choice.

The third is a used car from a respectable dealer, often

connected to a new car dealer. The dealership has likely checked the car to

know that it would be good for their used car sales reputation, even though it

does not provide the owner with a long or robust warranty.

The bottom is a “Buy Here, Pay Here” dealer who specializing

in selling high mileage cars to people with bad credit. The worst of these

dealers make their profit by selling the same car over and over again and the

buyer usually feels like the victim because they are. Don’t go there.

The wild card is buying from an individual. It could be a

great car, or it could be one that is just one expensive repair after another. Always

beware.

What kind of car should I buy? There are literally hundreds

of makes and models to choose from. Add

trims and options and the choices are mind-boggling. A few people really do need a pick-up for work

or a hobby, most people don’t. The fact that pick-ups are the largest selling

category is a recent North American phenomenon which somebody will write a book

about someday. If we need to haul things, a van or SUV may a better choice to

eliminate the problem of inclement weather.

Many people like SUV’s because of their versatility. These

are really just tall station wagons. Station wagons are currently out of style

in the United States, though station wagons are still the most popular body

style in many countries. Today, 52% of all cars sold in France are station

wagons.

Sedans come in every size and price range. If our goal is to get to work every day and stop for groceries on the way home, we don’t have to spend a lot of money. Since my wife and I think a good time means getting in the car and driving 3,000 miles, our requirements are for a car that will eat up the miles without beating us up in the process. That means a nice car with a comfortable riding experience.

Some people would rather go for a drive than fish or play

golf. They would gladly give up utility for driving pleasure. They would want a

car that is fun and responsive to drive. That might be a true sports car like a

Porsche or Corvette, or a sporty car like a Mustang or Camaro.

If we are in need of new car, we need to think carefully

about what our needs and values are. How important is being able to drive long

distances without getting tired? How often do I need to haul a bale of hay? Do

I need to pull a trailer? There are no right or wrong choices. I heard somebody

say that if you can get out of your car and walk away without taking a glance

at it over your shoulder and smiling, you bought the wrong car. I am in that

camp. Style is important too.

The most basic way to understand the expense of owning a car

is “cost per mile.” The biggest expense is generally depreciation. By looking

at the value of a car on Kelly’s Blue Book (www.kbb.com) on January 1st and

again on December 31st one will be able to see how much the car

depreciated or lost value during the year, or over several years. Add to that

amount insurance, taxes, maintenance, and fuel and divide by the number of

miles driven. Typically, this will be between 10 and 50 cents per mile. If we

only drive 2,000 or 3,000 miles a year, the cost will be closer to $2.00 or

$3.00 per mile. The easiest way to lower our cost per mile is to drive more.

Using this calculation, cars are made to be driven, not parked. Maintaining the car to keep it in the best

possible condition is always money well spent.

Knowing when to sell a car is also an important financial

consideration. We want to have received

good value from the automobile during the time we owned it, but keeping the car

too long can be very costly if we end up spending more on repairs than the

value of the car. When a particular car

has been a part of many wonderful memories, it is difficult to part with this

big, shiny companion. If the car owner

has not developed a sentimental attachment to the car it really makes it easier

to trade or sell the car to the next owner.

Really keeping up on the car’s Blue Book value should be part of the

decision, and some hard decisions just have to be made.

I have always had a love of cars, and you might also enjoy a

link to a song I wrote a few years ago, “What Would Jesus Drive?” (VIDEO)

Happy motoring!

Monday, May 25, 2020

Common Cents #5

Common Cents Issue #5

As I talk to people, it becomes clear that our views about

money and the way we utilize our resources can be the most common source of

strife in relationships, especially marriage.

Surveys show couples that argue about finances at

least once a week are thirty times more likely to get divorced than those

who don’t argue over money. High levels of debt and failure to communicate

about money issues are the leading causes of stress and anxiety in family

relationships.

It appears, though, that lack of

money is not the cause of divorce as much as the failure to communicate about how

the money we have will be spent. The old joke, which isn’t very funny, is about

the guy who is afraid that when he dies, his wife will sell his stuff for what

he told her he paid for it. Fill in the blank for your “stuff”, whether it is guitars,

cameras, boats, or guns.

I know of men who complain about

the hundred dollars a month their wives spend on shoes, and then try to sneak

in a $1,000 shotgun without her knowing it.

To begin to resolve this major

source of conflict, there must be an understanding of how much it actually

costs to pay the monthly costs of a family’s basic needs. This can only be

arrived at by communication of what those financial commitments truly are. Then, allotting a certain amount of

discretionary money to each person for them to spend as they wish should be

considered. There must be a clear understanding of how much money is spent on

things like housing, food, transportation, insurance, and retirement savings.

Then, one can discuss how much can be spent on travel, eating out, or “toys.”

One way my wife and I have found to

accomplish this is to have regular “business meetings.” A business meeting indicates

that it is not a time filled with high drama or emotions, but rather is just

look at the numbers and how they add up.

We discuss what has happened since we last met and we plan what we expect

to do until the next business meeting is held.

We have an Annual Meeting on

January 1 of each year. We plan for an all-day meeting, but a few hours are often

all we need. We look at what we had planned for the previous year and talk

about our successes and what was not able to be accomplished. We talk about the next year’s vacation plans,

investments, and when we would like to make major purchases like a new car or a

home remodel project. Some of these things are planned years in advance; others

don’t need so much lead time. It is at our annual meeting where we realign our

priorities and make overall long-range decisions. Buying a new house, changing

jobs, or starting a new business would all be topics for the annual meeting

discussions. Most of the best decisions we have made have taken place in this

manner.

We also have quarterly meetings

which are shorter and involve seeing how we are doing on the annual plan. We

look at our quarterly income and net worth statement to see if we are on track

or see if we should make any adjustments to our spending plan. Sometimes we

have to make major changes to the annual plan. This year, for example, the worldwide

pandemic drastically changed our plans. Mainly we just pushed some things

planned for 2020 into 2021. No big deal, no panic, we just lost a year on some

travel plans and will adjust other items as needed.

We have monthly meetings which are

shorter yet, ten or fifteen minutes, to discuss things like unexpected expenses

or to generally check in. If one of us is planning to buy some new clothes or

some other item is needed, we talk about it at the monthly meeting so there are

no surprises the next month. I might say something like, “I need some new running

shoes, should I wait until next month, or is this month OK?” The discussion

would be about what other expenses are coming up that are more urgent. This is

primarily to manage cash flow.

The point is that the business

meetings are not emotional. They are matter of fact, this is where we are, this

is what we need to do to get where we want to go.

We haven’t always done things this

way. The years when we had no idea where we were financially or which way we

were going were so uncomfortable to us that we have adopted this strategy and

it has worked well for us. We have learned that business meetings and frank

talk about money are essential to a long and happy relationship. It gives us both ownership of our financial

life and a strong partnership in this area of our life has led to trust and

confidence that our plans will be accomplished.

Jim Mathis

Monday, May 18, 2020

Common Cents #4

|

|

Monday, May 11, 2020

Common Cents #3 Inflation

Monday, May 4, 2020

Common Cents #2

|

|

Common Cents # 50 Tax Time

Common Cents – Tax Day There are only three things that I know a lot about: the Bible, photography, and taxes. I also have opinions abo...

-

Common Cents – Tax Day There are only three things that I know a lot about: the Bible, photography, and taxes. I also have opinions abo...

-

Gift Giving The custom of giving gifts goes back to the beginning of human history and is an important feature of every culture. When ...

-

Coins An interesting current topic of conversation is about a “cashless” society and what that means to the average consumer. We’v...